Tax-Free First Home Savings Account (FHSA) arrives on April 1st, 2023.

What is the Tax-Free First Home Savings Account (FHSA)?

How does it work?

Benefits of the FHSA?

What strategies can you use to make the most of it?

What is the Tax-Free First Home Savings Account (FHSA)?

A brand-new type of account called Tax-Free First Home Savings Account (FHSA) Canadian residents can use to save for their first home in Canada. It blends characteristics of both RRSPs and TFSAs and, when used correctly, can fully bypass income tax.

How does it work?

- Contributions are tax-deductible – just like an RRSP. And withdrawals can be tax-free – just like a TFSA. The lifetime contribution limit is $40k, and the annual contribution limit is $8k. Unlike the HBP, you don’t need to pay it back.

- The Contributions do not impact your RRSP room, and they do not need to be deducted in the year they are made. Like an RRSP, if you contribute but want to carry the deduction forward to a year when you’re in a higher tax bracket – you can.

- You can invest your FHSA in stocks, bonds, mutual funds, ETFs, GICs, and savings accounts. Like a TFSA, there is no limit on how much you can withdraw, only how much you can contribute. And investment income earned while in the plan is tax-free.

Your FHSA must be closed by December 31st on the soonest of:

- 15th year after you open it.

- The year you turn 71.

- The following year of your qualified home purchase. The balance can be taken as taxable cash or rolled over, tax-deferred, to your RRSP.

Who can open Tax-Free First Home Savings Account (FHSA)?

- First-time home buyers between the ages of 18 and 71.

- A first-time home buyer means you cannot have lived in a home that you or a spouse/common-law partner owned in the current year or the previous 4 calendar years.

- You can only use the FHSA once. Like the RRSP, TFSA, and RESP, if you over-contribute, there are penalties.

- It’s 1% of the excess amount per month until withdrawn. Unless you know a way to get guaranteed 13% annualized returns (you don’t, even with dividend stocks), don’t over-contribute.

How do I withdraw money from my Tax-Free First Home Savings Account (FHSA)?

To qualify as tax-free, you must buy the home by October 1st of the year after the withdrawal. So, if you withdraw it in 2026, you must buy the home by October 1st, 2027, regardless of the month you withdraw the funds in 2026. You can also withdraw funds from your FHSA up to 30 days after you purchase the home. If not, the withdrawal will be fully taxable. You’ll need to provide purchase details to your financial institution.

Can it be used with the RRSP Home Buyers’ Plan?

Yes! The first draft of the legislation specifically said no – you would have to choose one or the other. However, in the final version, this language was omitted. You can use both for the same home purchase.

What about incorporated professionals and business owners?

If you pay yourself only dividends, you don’t generate any RRSP room. But with the FHSA, you’re given $40k in free room to transfer to your RRSP later. If you qualify, max it out.

Even if you do pay yourself a salary and have RRSP room – consider the FHSA first. Since you can always transfer the FHSA to an RRSP later, this preserves your RRSP room and takes advantage of the $40k in FHSA room while you qualify as a first-time home buyer.

What are the downsides of a Tax-Free First Home Savings Account (FHSA)?

Honestly? None that we can think of. At best, it fully bypasses income tax to buy your first home. At worst, it’s a free $40k in RRSP contribution room. My guess is they will slowly phase out the Home Buyers’ Plan in favour of the FHSA.

Any tips and tricks? Yes. Many, in fact. (courtesy of @markmcgrathcfp)

Think about filling your FHSA before your RRSP since you can always transfer the FHSA to the RRSP if you don’t use it. Once maxed, any remaining savings for your home purchase can go to a TFSA, RRSP, or non-registered account, depending on your circumstances.

Consider transferring money from your RRSP to your FHSA up to the annual & lifetime limits. Useful if you’ve been funding an RRSP, won’t be able to max both the HBP and the FHSA, and don’t want to repay the withdrawal from the HBP. You won’t get a tax deduction, though.

If you’re gifting money to your adult kids, consider funding an FHSA for them. There’s no tax on cash gifts to adult kids. They can carry the deductions forward and use them in years with higher tax brackets. This will preserve their RRSP room for use in later years.

Fund your spouse or common-law partner’s FHSA too. While you can’t fund a spouse’s RRSPs without invoking the attribution rules, you can fund a spouse’s FHSA. No tax will be attributed back to you on the withdrawal, regardless of whether you use it for your first home.

Use the HBP and the FHSA together if you can. With a spouse, this could be over $150k in total funding for a down payment. The HBP portion will be required to be paid back over 15 years at most, starting the second year after the withdrawal.

Open an FHSA even if you don’t plan on buying a home. It’s free RRSP room in that case. You can preserve your RRSP room for later use. Why not take it?

It can be used if you have a rental that you never lived in If you bought a rental but never a primary residence, you might still qualify under the definition of a first-time home buyer. Remember, to qualify, you cannot have lived in a home you or your spouse owned.

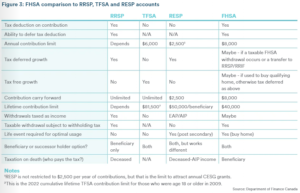

Lastly, here is a great chart courtesy of @aaronhetorcfp that breaks down some of the similarities and differences between RRSP’s, TFSA’s and the FHSA:

The FHSA should be high on your consideration list as the first option for funding a home purchase. When used properly it combines the best parts of the RRSP and the TFSA. And at worst – it’s free RRSP contribution room. For more information: Click Here

Looking to start the process of applying for a mortgage? Click Here to get started.

UPDATE April 2023:

All of the Big 6 banks confirmed that they won’t be in a position to offer the new account to clients until later in the year.

However, the country’s largest banks say they are still working to finalize the logistics of offering the account to clients, including obtaining the required government authorizations and awaiting tax reporting guidelines from the Canada Revenue Agency. Most expect to offer the account later in the 2023 tax year. Here are the official responses from each of the six banks, along with their FHSA pages where they will share more information once the accounts become available:

BMO

- Tax-Free First Home Savings Accounts (FHSA) will be available to BMO customers including BMO Wealth clients, starting with an offer through our retail bank and wealth advisory channels for the 2023 tax year. We’ll be expanding the offer to other channels in the future and updates will be posted to BMO’s FHSA website.

- BMO’s FHSA webpage

CIBC

- “We are excited to bring another savings opportunity to our clients later this year and, as information becomes available, plan to share an update regarding timing in the coming months.”

- CIBC’s FHSA webpage

National Bank of Canada

- “We’re working to make the FHSA available to our clients as quickly as possible after the legislation comes into effect on April 1. At this time our team is making every effort to complete the necessary technological development.”

- NBC’s FHSA webpage

Scotiabank

- “In addition to the wide variety of savings products we offer our customers today, we’re targeting to offer the new first-time homebuyer’s savings account to customers in the 2023 tax year.”

- Scotiabank’s FHSA webpage

Royal Bank of Canada

- “We expect to launch FHSA this spring, but we don’t have further details to share at this time.”

- RBC’s FHSA webpage

TD

- “TD understands that saving for your first home is one of the most important financial journeys for Canadians, so we are working to ensure the FHSA has the features and benefits that Canadians need when we launch it later in 2023.”

- “In the meantime, customers can visit our public webpage to learn more about it, and once the FHSA becomes available, we encourage those interested to book an appointment with a TD Personal Banker at any of our branches across the country.”

- TD’s FHSA webpage