How do I fill out a TD1 for my employer?

You just got a new job! Congrats! But they tell you to fill out this form: TD1. You don’t know much about income tax and are confused about this form. Here is How do fill out a TD1 for my employer?

What is a TD1 form?

TD1 Personal Tax Credits Return, is a form that is used for calculating how much tax should be deducted from payments. NOTE: There is usually also a provincial form, not included in this thread.

When do you need to fill out the TD1 Form?

When starting a new job, when your Income, Tax, Employment situation has changed, or when you want to increase deductions that are taken from your pay cheque. Form TD1, Personal Tax Credits Return, must be filled out when individuals start a new job or they want to increase income tax deductions. This is used to calculate the amounts to withhold from their employment income or other income, such as pension income.

Make Sure Your Understand Tax Credits?

- Basic Personal Credit:

$15,000 This is a credit given to everyone. So everyone will get to reduce their total tax bill by $15,000 x 15%. - Disability Tax Credit:

$8,576 This is a credit given to someone with a disability approved by CRA. Value is $8,576 x 15%. - Tuition Fees:

Cost of tuition — This is a credit given to students who pay eligible tuition fees. The value is the Amount of Tuition x 15%. - The TD1 Form lists the different credits that you can claim. Those aren’t all the credits that exist, but they are the ones you can claim on a TD1.

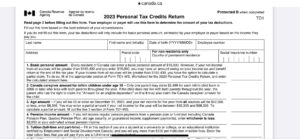

How to Fill Out the TD1 Form:

The first part of the TD1 Form is simple, it’s your ID information. Enter all the required parts.

The second part is where the challenge comes in, but it’s not to difficult. Go through each line and see what credits you’re eligible for to reduce your income tax obligation. Some people will only take the Basic Personal Credit and not claim any of the others, even if they’re eligible (Don’t make this mistake). Does that mean they’re paying more tax than they need to? No, this is only to determine how much tax that needs to be deducted from your paycheque. If more tax was taken than required, you will get that refunded when you file your annual income tax return.

The first credit is the basic personal. Since everyone can put $15,000. If you’re making over $165k, your basic personal amount is actually reduced (not by a lot) and you can calculate it a different way and report that calculated amount. Or you can keep it at $15k.

The next few credits can only be claimed if you’re eligible. Even if you are eligible, you don’t need to claim them for purposes of your pay cheque deductions. You can just claim them when you actually file your tax return.

Below is a list — Read through each one and see if it applies to you. If it does, put the stated amount in the TD1 Form.

Then you want to total all the different credits you have and put the total at the bottom. So when you’re finished you now have to complete the second page.

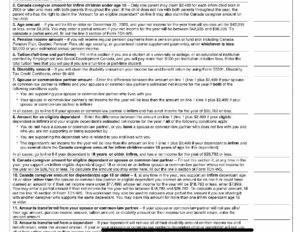

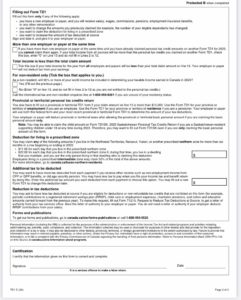

The second page is a lot simpler. One area asks if you have more than one employer at a time. Why do they ask that? Because one job is already applying these tax credits for you. If you tell your second employer to do the same thing, then you’re double dipping. If this is the case, you have to check the box and then you have to go back and put all 0’s on the first page.

Another area asks if your total income will be less than the total of your credits. If that’s the case, then even less tax needs to be deducted for your paycheque due to the availability of your credits. Check that box off if that’s the case. There are other areas if you’re a non-resident or you live in the Territories. You would have to complete those if those apply to you.

Two Important Sections at the Bottom of the TD1 Form Page 2:

- If you want more tax to be deducted from your pay cheque.

- If you want less tax to be deducted from your paycheque It’s important to remember your actual tax will be determined when you file your tax return. This is just for your pay cheque.

If you have other income (I.e investment income) and hate paying tax when you file your tax return, you can ask that you have more tax deducted. If you know you’ll have a refund (i.e. due to RRSP contributions) and don’t want to wait until you file your tax return to get it, you can complete a separate Form T1213, submit it to the CRA, get it approved, and then give it to your employer.

Sign/ Date/ Submit — Don’t forget to do the provincial form, they are usually very similar to the TD1 Form. Remember, this can be updated and resubmitted if your situation changes at any time.

For more information Click Here: