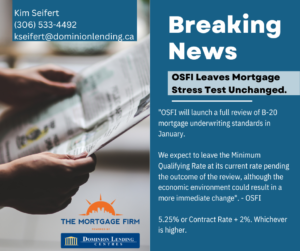

OSFI leaves mortgage stress test unchanged:

OSFI will launch a full review of B-20 mortgage underwriting standards in January. The Stress Test created an environment of parents/ grandparents to not only helping with down-payments but also co-signing mortgages to meet new Stress Test requirements of 5.25% or Contract Rate + 2%, whichever is higher!

With co-signers and help with a down-payment did OSFI regulations solve what it was intended to do?

OSFI Canada unveiled 3 proposed measures that would further restrict mortgage lending:

Pending the just-launched consultation period, if adopted.

1) Loan-to-income & debt-to-income restrictions.

2) Debt service coverage restrictions.

3) Interest rate affordability stress tests.

“Rising household debt is a significant vulnerability to mortgage lenders.”