What does the First-Time Home Buyer Incentive offer? The incentive is a shared-equity mortgage with the Government of Canada.

- 5% or 10% for a first-time buyer’s purchase of a newly constructed home

- 5% for a first-time buyer’s purchase of a resale (existing) home

- 5% for a first-time buyer’s purchase of a new or resale mobile/manufactured home

The Incentive’s shared-equity mortgage is one where the government has a shared investment in the home. As a result, the government shares in both the upside and downside of the property value.

By obtaining the Incentive, the borrower may not have to save as much of a down payment to be able to afford the payments associated with the mortgage. The effect of the larger down payment is a smaller mortgage, and, ultimately, lower monthly costs.

The homebuyer will have to repay the Incentive based on the property’s fair market value at the time of repayment. If a homebuyer received a 5% Incentive, they would repay 5% of the home’s value at repayment. If a homebuyer received a 10% Incentive, they would repay 10% of the home’s value at repayment.

The homebuyer must repay the Incentive after 25 years, or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full any time before, without a pre-payment penalty.

LEARN MORE ABOUT THE FIRST-TIME HOME BUYER INCENTIVE

Looking for homebuying tools and resources?

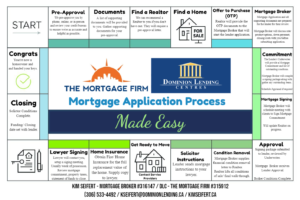

Knowing what to expect throughout the entire homebuying process can lead to more well-informed decisions, and a better homebuying experience overall.

Check out all the homebuying tools and resources below to help you make your homebuying decisions with confidence.

Guides

Calculators

Other useful information

- Your Credit Report – Learn more about the simple steps you can take to maintain a good credit history and improve your chances of being approved for a mortgage.

- Mortgage Planning Tips – See how planning your mortgage in advance can help you save money in the long run.

- Mortgage Fraud – Read these valuable insights that can help protect you from mortgage fraud.

Ready to Apply for a Mortgage? Apply Now

Kim Seifert

Mortgage Broker lic# 316147

M 306-533-4492 | F 306-545-7446| kseifert@dominionlending.ca

The Mortgage Firm lic# 315912

3889 Arcola Ave E, Regina, SK S4V 1P5