New 2023 Tax Measures include tax incentives for new homebuyers and tax on non-resident property owners.

First Home Savings Account:

The FHSA allows certain homebuyers to save up to $40,000 toward a home purchase, with a maximum annual contribution of $8,000 over five years. Contributions to the FHSA are tax-deductible and withdrawals to purchase a home are tax-free.

Another new tax benefit related to housing is the Multigenerational Home Renovation Tax Credit:

The refundable tax credit will provide up to $7,500 “in support for constructing a secondary suite for a senior or an adult with a disability to live with family members.”

Eligible families can claim 15% of a maximum of $50,000 in home renovation and construction costs to build a secondary housing suite.

New taxes on home-flipping, vacant housing:

The change means the government will assume anyone who sells a home after possessing it for less than 12 months will be considered to be flipping the property. Profits from the sale would be considered business income, not capital gain.

The government is also introducing an Underused Housing Tax (UHT):

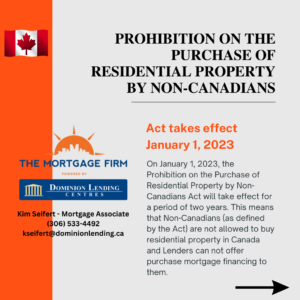

“The UHT is a national, annual 1% tax on the value of vacant and underused residential property in Canada owned directly or indirectly by non-residents, non-Canadians. Any non-resident, non-Canadian who owns an underused or vacant residential property in Canada as of December 31, 2022, will have to file a UHT return for the property by April 30, 2023.

There are some exceptions to the UHT. They include exceptions for seasonal properties and properties made inaccessible by a hazard.

Other 2023 Tax Measures listed in image below.