How Personal Taxes Work in Canada — They contain 3 calculations. If you look at your actual personal tax return, you will see it essentially follows this format.

Add: Income Minus: Deductions Equals: Taxable Income

Add: Taxable Income Times: Tax Rates Equals: Tax Otherwise Payable

Add: Tax otherwise Payable Minus: Tax Credits & Payments Equals: Tax Owing/Refund

HOW PERSONAL TAXES WORK IN CANADA — So How Do You Pay Less Tax?

If you follow the formulas, you would see that any of these will have you pay less tax.

- Earn Less Income or Earn Income That is Exempt From Tax

- Earn investment income through TFSA/RRSP/FHSA/RESP so that it’s not reported on your return

- Have someone else earn income (income splitting)

- If you have self employment income, considering earning that income through a corporation

- Increase Deductions

- Deductions reduce your income and as such, you will pay less tax.

- Take advantage of employment expenses, negotiate with your employer to make it a condition of employment

- Make RRSP contributions – Claim child care expenses if you’re eligible

- Earn (legitimate) business income so that you can deduct business related expenses

- If you sell as part of your work, negotiate some commission income as commissioned employees can deduct more expenses

- Lower Your Tax Rate

- Different incomes have different tax rates. Dividends & capital gains are taxed at lower rates than employment income. There is a lot less flexibility here. You should also strive to max out RRSP/TFSA/FHSA before earning capital gain/dividends personally

- Increase Your Tax Credits

- Make eligible donations

- if you have a disability, apply for the disability tax credit

- claim medical expenses

- There are a bunch of tax credits, take a look through them to make sure you’re taking advantage of all of them.

Here is a list of all the tax credits and deductions, scroll through them to see if you are eligible for any that you might not have claimed. Click Here

I hope you find this information on HOW PERSONAL TAXES WORK IN CANADA helpful.

Source: Canadian Tax Guy @TheTaxHeroes

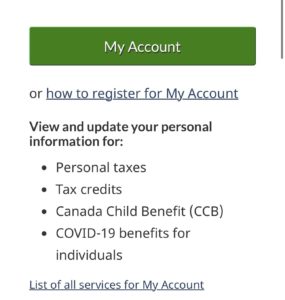

Every Canadian who pays taxes should know how to access to their CRA My Account.

So. what is the CRA My Account?

This is an online portal that summarizes your current standing with the Canada Revenue Agency. If this is your first time using CRA My Account, here’s a thread on how to register.

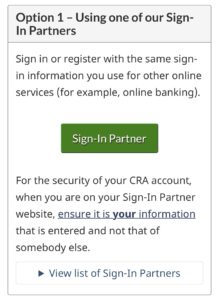

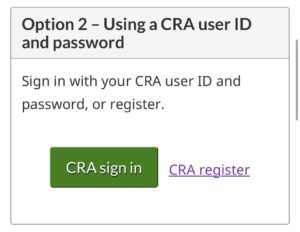

- Using the “Sign-In Partner” (Signing in through your online banking)

- Signing in with your official CRA login details. (Press CRA register) *The following steps apply to both options when initially signing in*

PS – there’s a 3rd option which is signing in through a Provincial partner. At the moment, this is only available in Alberta and BC using your “MyAlberta Digital ID” or your “BC Services Card.” For simplicity, Let’s walk through the “Sign-In Partner” option using your online baking details. This is the easiest method because you don’t have to create and remember a separate login. Hit this link and follow the steps below: Link

Step 1: Press “Sign-In Partner” and select your bank *Please note you’re only limited to the banks available on this list. If your bank is not on this list you’re limited to Option 2 (To register for a login with CRA).

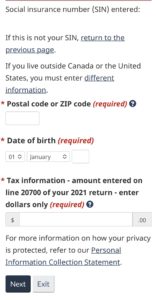

Step 2: Once signed in, Enter your Social Insurance Number, press “Next”. This is the start of a few steps to verify your identity.

Step 3: Enter in the following details: – Postal Code – Birthday – The requested line item from your most recent tax return. In this example it’s line 20700: (If you don’t know this information, go check your files or ask your parents).

Step 4: The next page explains that the CRA will send you a letter with a security code, via snail mail to your house within 5-10 business days. Press “Next” The next page will ask you to verify that the postal code provided is correct. Once confirmed, hit “Next” again.

Step 5: At this point you’ll have limited access to your My CRA Account until your letter comes (5-10 business days). Once your letter arrives, log back in and enter the security code to gain full access.

Once you have full access, CRA My Account also allows you to track your refund, view or change your tax return, view contribution limits, check your benefit/credit payments and much more. NOTE: Especially important for business owners. It’s so easy and helpful to have direct access to your own records. The instructions above from Jordan Dawit @JordanDawit are only breaking out the personal side of the CRA My Account. KNowing how to Create a CRA MY ACCOUNT and HOW PERSONAL TAXES WORK IN CANADA should come in extremely handy.

The CRA My Account comes in extremely handy when applying for a mortgage. So, make sure you sign up before you apply for a mortgage as it could take 2 or more weeks to get full access to the site.

Well you are here check out the most current rate specials: Here