Saskatchewan Residential Sales in 2022

Saskatchewan continues to report sales that are stronger than pre-pandemic levels.

Regional Highlights: Source — SRA

Sales eased across all regions of the province this year, with declines ranging from 27 per cent in Melfort to two per cent in Swift Current. Despite the pullback in sales relative to 2021, a record year, all regions reported sales that were either consistent with or above long-term trends. All regions across the province also saw a pullback in both new listings and inventory levels. Average annual inventory levels not only declined relative to last year but were well below long-term trends across all regions.

City of Regina

Easing sales in December contributed to a year-to-date decline of three per cent. The decline in sales was driven by pullbacks in the detached sector, as sales activity improved in every other category. While total residential sales have eased relative to a record 2021, the 3,609 sales reported in 2022 is over 23 per cent higher than long-term trends and well above pre-pandemic activity.

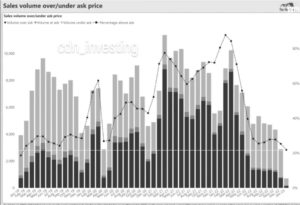

Both new listings and inventory levels experienced a pullback in 2022, with the decline in inventory largely in products priced below $500,000. Shifts in both sales and supply resulted in increasing months of supply when compared to levels experienced early in 2022. While this did take some pressure off prices, especially in Q4 2022, the benchmark price increased by over three per cent on an annual basis.

City of Saskatoon

The City of Saskatoon reported 4,587 sales in 2022, a 15 per cent decline over last year’s record high but over 12 per cent higher than 10-year trends. Supply continues to be a challenge, as new listings have eased significantly and were 14 per cent below long-term averages in 2022. Meanwhile, inventory levels eased even further, resulting in average supply levels 31 per cent below long-term trends.

While a pullback in sales relative to inventory levels in the second half of the year did allow the months of supply to rise, the market remains far tighter than what we would traditionally see in Saskatoon. On an annual basis, benchmark prices rose nearly five per cent over 2021 levels.

Further to Saskatchewan Residential Sales in 2022 —

Homes Listed for 30+ days!