Impact Regina Economic Indicators

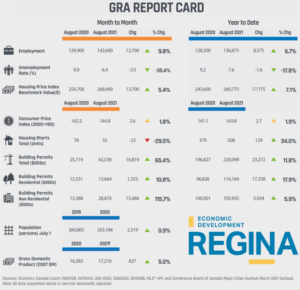

The local economy remains resurgent in the third quarter of 2021. Year-to-date employment is increasing at more than twice the rate than that experienced at the provincial level and the average year-to-date unemployment rate is down 1.6 per cent from 2020.

Aside from the ever-present potential of a Covid-related economic disruption, challenges to Regina include minimal commercial and industrial building permit data, slowing new home construction and looming inflationary concerns, which could result in increases in borrowing rates beyond 2021.

Impact Regina Economic Indicators for September 2021:

EMPLOYMENT

- Average year-to-date total employment in the Greater Regina Area was up 6.7% or 8,575 positions in August 2021 over the same period in 2020; almost completely erasing the 8,760-employment loss experienced in 2020.

- The average year-to-date unemployment rate moved from 9.9% in August 2020 to 6.4% in August 2021. Year-to-date, the average number of unemployed is down -1,763 to 11,163 from 12,925 In August 2021. In addition, the number of those of labour-force age but not in the labour force decreased by -4,450 over the same time period, as individuals return to the labour market with improved prospects.

- In August 2021, year-to-date employment was strongest in the wholesale and retail trade (4100), educational services (2063) and public administration sectors (2375) while these sectors faced the most challenges: information, culture and recreation (-2,100); transportation and warehousing (-1,050); and other services (-1,013).

- On the strength of strong residential and non-residential construction activity, year-to-date August 2021 construction employment is up by 1,825 (21.5%) positions from the same period in 2020.

HOUSING

- August 2021 total year-to-date housing starts are up by 129 units or 34.0%. Year-to-date increases were observed in singles (78 units or 58.6%), semi-detached (2 units or 6.7%), and apartment and other types (98 units or 81.0%) while declines were limited to row (-49 units or -51.6%). It should be noted that, on a year over year basis (August 2021 vs. August 2020), housing starts are down -29.5% or -23 units.

- August 2021 year to date building permits are up 11.8% over the same period in 2020. Sub sectors that posted increases were residential (17.9%) and institutional and governmental (130.1%), while, industrial (-6.1%), and commercial (-5.3%) posted declines.

- The average year-to-date Housing Price Index Benchmark Composite Price is up from $243,600 in August 2020 to $260,775 in August 2021.

OUTLOOK

- With three rapid cuts on March 4, March 13, and March 27, 2020, the Bank of Canada reduced its benchmark interest rate to 0.25. In its July 2021 economic outlook, the Bank indicated that it will keep the rate at near-zero until the economy is ready to handle an increase in rates, which it doesn’t expect to happen until the second half of 2022.

- Regina Census Metropolitan Area population was up 2,319 or 0.9% from 260,865 in 2019 to 263,184 in 2020. Slowing population growth was due to travel restrictions and their impact on international in-migration and weaker than expected inter-provincial net migration.

- The Conference Board of Canada estimated that Regina’s real GDP dropped by 3.8 % in 2020. Real GDP is expected to advance by 5% in 2021

Source: Economic Development Regina

Impact Regina Economic Indicators is a joint initiative between Economic Development Regina Inc., Praxis Consulting, and SJ Research Services. It provides a concise Economic Report Card of key economic indicators for the Greater Regina Area, updated monthly.

Kim Seifert

Mortgage Broker lic# 316147

M 306-533-4492 | F 306-545-7446| kseifert@dominionlending.ca

The Mortgage Firm lic# 315912

3889 Arcola Ave E, Regina, SK S4V 1P5